pinellas county sales tax rate 2019

Pay taxes online and see where your tax dollars go. The 2018 United States Supreme Court decision in South Dakota v.

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas.

. PINELLAS COUNTY Pinellas County Tax Collector Charles W. June 4 2019 329 PM. Pinellas County Florida - Resident information - taxes and budget.

Property Taxes in Pinellas County. 05 lower than the maximum sales tax in FL. Effective January 1 2019 the sales tax rate for such rental payments will be reduced from 58 to 57 for rental payments received for occupancy periods beginning on or.

Pinellas County FL Sales Tax Rate. The latest estimates put the rate reduction to take place sometime during 2024. There is no applicable city tax or.

This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes. Any certificate struck to the county at a sale will not be available for purchase until the first business day of September.

So the current Florida sales tax rate on commercial rent as of January 1 2022 is 55 plus the. The 7 sales tax rate in Pinellas Park consists of 6 Puerto Rico state sales tax and 1 Pinellas County sales tax. County Budget Information - your suggestions.

The latest sales tax rate for Pinellas County FL. This rate includes any state county city and local sales taxes. Rate Tax History Rate Tax History 120 Living and Sleeping Accommodations 110 Living and Sleeping Accommodations 70 All Other Taxable Transactions 70 All Other Taxable.

The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state reciprocal with. 2020 rates included for use while preparing your income tax. To purchase Pinellas County held certificates register online at LienHub.

The 7 sales tax rate in Pinellas Park consists of 6 Florida state sales tax and 1 Pinellas County sales tax. Update Address with the Property Appraiser. What is the sales tax rate in Pinellas County.

In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. The minimum combined 2022 sales tax rate for Pinellas County Florida is. The cities of Florida andor municipalities do not have a city sales tax.

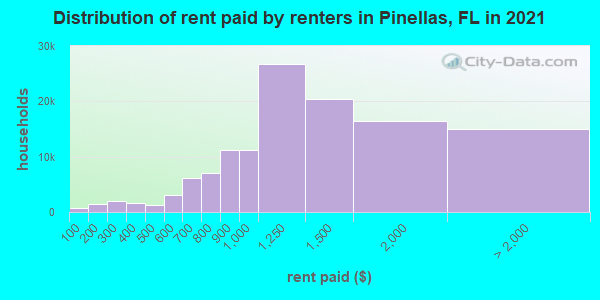

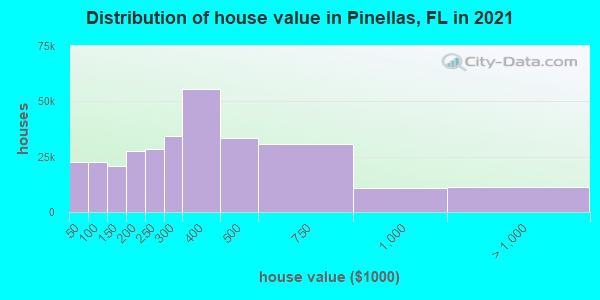

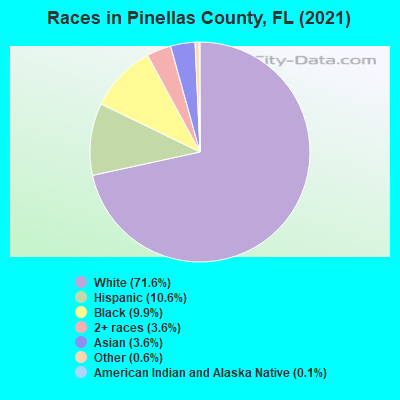

Pinellas County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

How To File And Pay Sales Tax In Florida Taxvalet

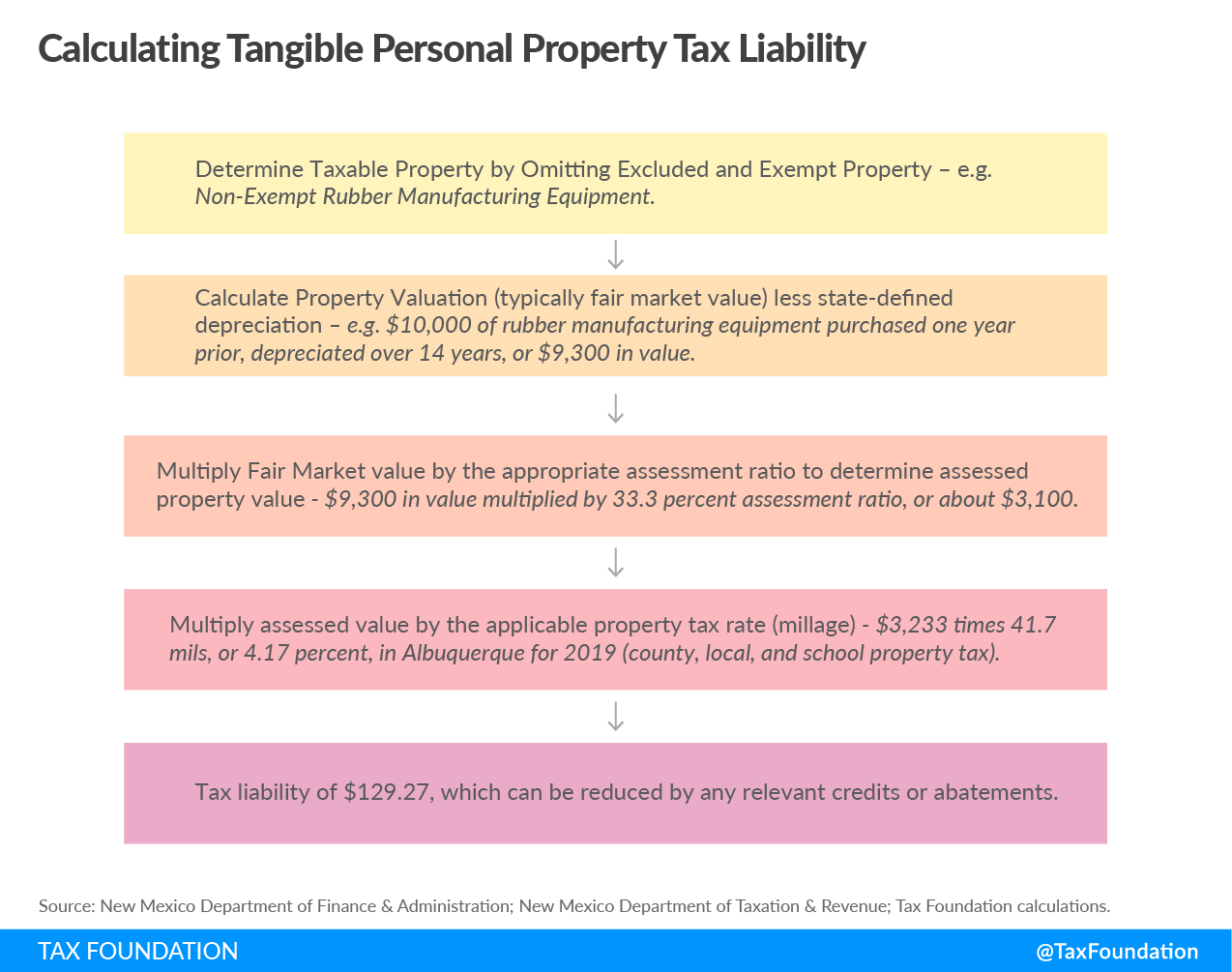

Tangible Personal Property State Tangible Personal Property Taxes

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Pinellas County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Pinellas County Florida Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Your Guide To Prorated Taxes In A Real Estate Transaction

Pinellas County Keeps 2021 Property Tax Rates The Same And Prepares For Covid 19 Impacts

Taxsys Pinellas County Tax Collector

U S Sales Tax Setup For Business Central

U S Sales Tax Setup For Business Central

How To Report Florida Sales Tax Xendoo

Florida Property Tax H R Block