sports betting in ct taxes

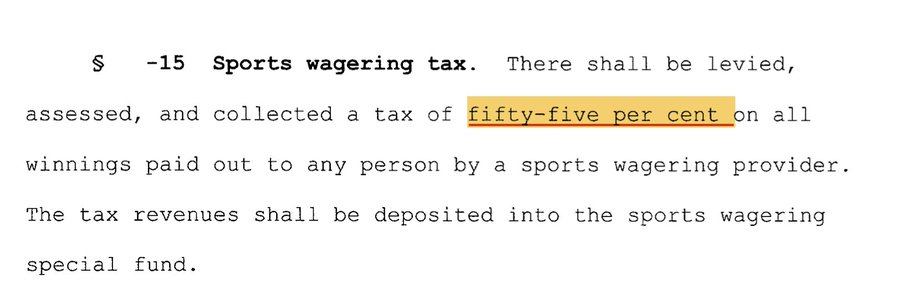

The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. Sports Betting can help fill the state budget hole.

Sports Betting Taxes If You Bet In 2021 The Taxman May Be Coming Marketwatch

If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it.

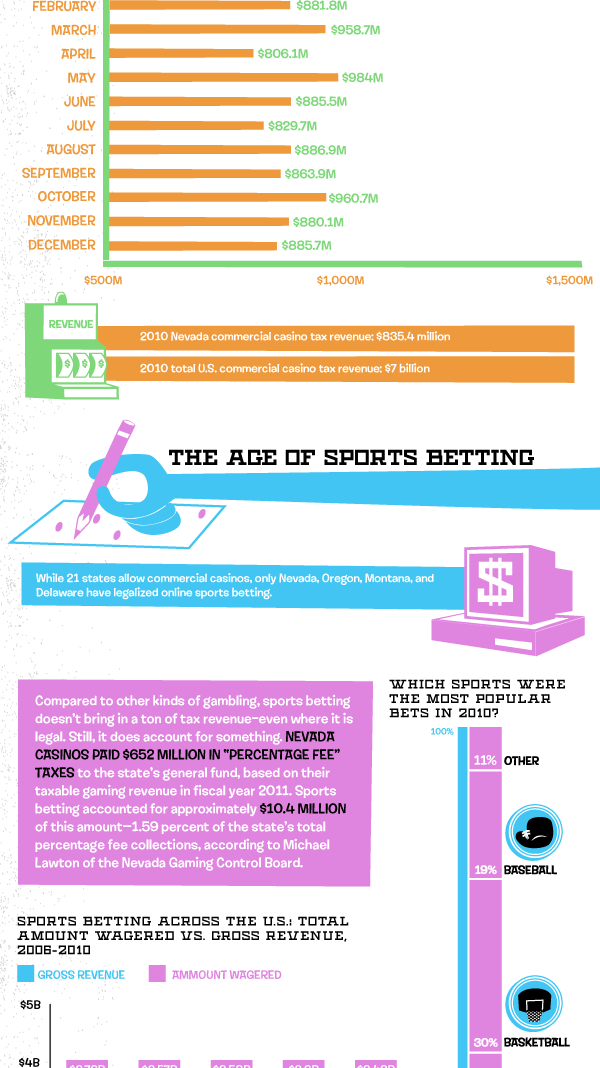

. Sports betting tax rate. As for the state as a whole it expects to draw in 30 million in the first year eventually ramping up to an estimated 100 million a year by taxing online sports betting at. Winnings From Online Sports Sites Are Taxable.

Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. The Constitution state officially went live with online sports betting on October 19 2021. Sportech is a qualified partner to the State of Connecticut regulated and ready to take action on Sports Betting in its venues and online.

Connecticut income tax will not be withheld from gambling winnings if the payer does not maintain an office or transact business in Connecticut if the payment is not subject to federal. The legislation he signed into law May 27 imposes an 18 tax for the first five. 0144 AM 6 October 2022.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. Since PASPA was repealed by the Supreme. Sports betting is expected to bring in about 19 million in the first year and 23 million in tax revenue in the second year of the budget.

Yes online sports betting is legal in Connecticut. Changing the compacts had been a critical step to bringing sports betting to Connecticut. The Connecticut sports betting tax rate will be 1375 from revenues generated.

This rate applies equally to both the. Gambling losses are not deductible for Connecticut income tax purposes even though in certain circumstances they are deductible for federal income tax purposes. The critical details of how the Connecticut online sports betting market will work are below.

Sports betting has been flourishing in Connecticut since governor Ned Lamont signed the legalization bill into law in May 2021. The state will collect taxes of. Connecticut state taxes for gambling State law in Connecticut requires prize grantors to withhold 699 on all gambling winnings that are either.

Ned Lamont announced that. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income. Those numbers will increase with.

Reportable for federal tax purposes OR Subject. The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. Facilities are required to withhold 24 of your earnings for.

While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax. This was after Gov. Sports betting can be legalized at the state level since 2018 and states all across the country are looking at legalizing and taxing online betting.

Proceeds will go to a college fund to allow students to attend.

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Information For Taxes Ct Playsugarhouse

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Sports Betting Taxes Guide How To Pay Taxes On Sports Betting The Turbotax Blog

Free Gambling Winnings Tax Calculator All 50 Us States

Tpc S Sports Gambling Tip Sheet Tax Policy Center

Betting And Betting Ct S Expanded Gambling Yields Billions

Mobile Sports Betting Operators May Not See Profits In New York State Crain S New York Business

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Hawaii Sports Betting Bill Includes Industry High Tax Rate

How Will Legal Sports Betting Affect Your Income Taxes Credit Karma

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022

Connecticut Gives The Ok For Sports Wagering And Online Gambling

You Can Bet On Taxes Marcum Llp Accountants And Advisors

Do You Have To Pay Sports Betting Taxes Smartasset